FOMC Week

Canada and US Rate Decisions

Good evening!

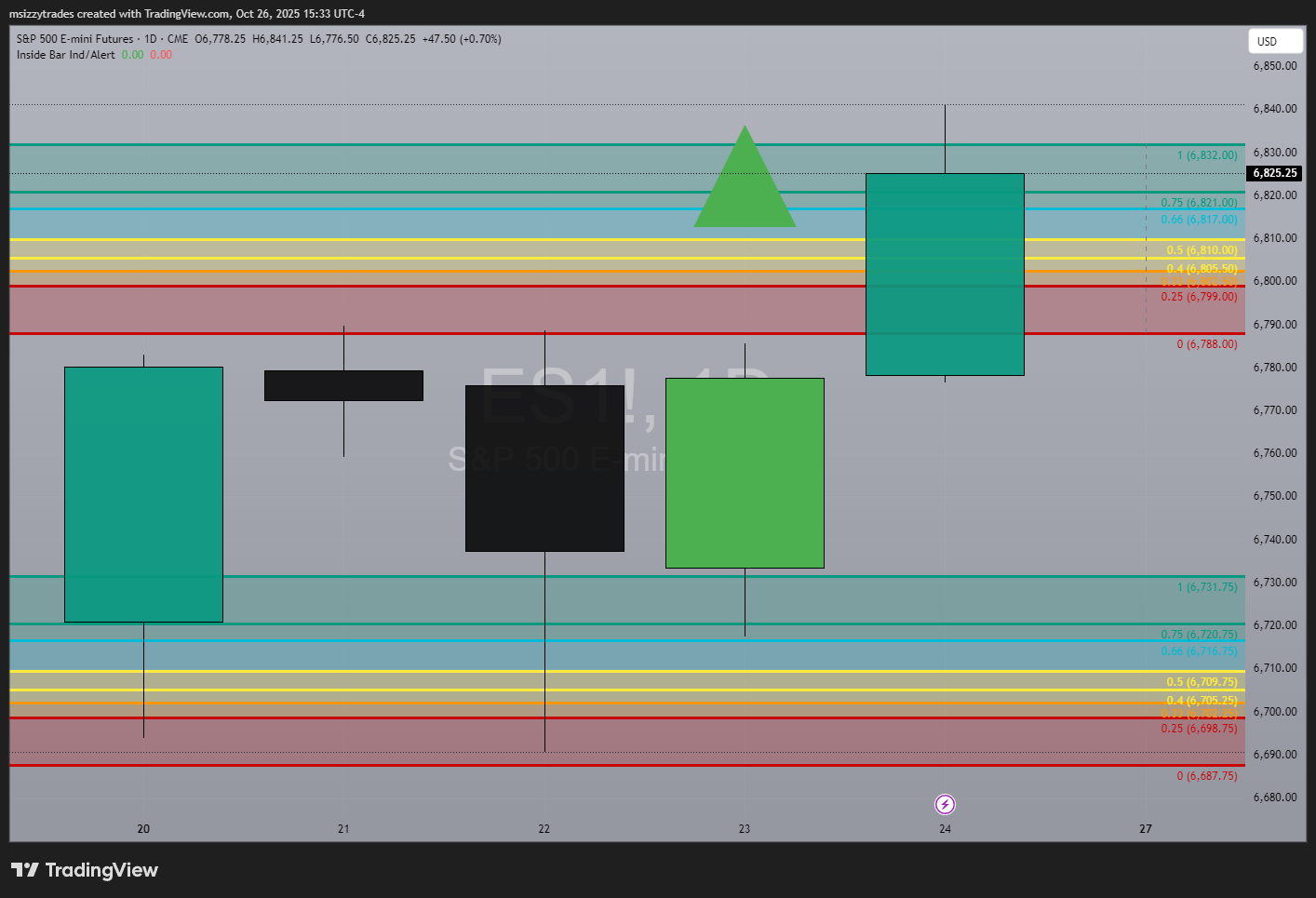

What a week this past week! Not only did we sustain perfect ranges right above our zone at 6688, we even managed to break back into our ATH zone, above 6788 and snap ATH. Breaking us over 6822/6832, taking us to the channel. This is the perfect case scenario for us ahead of month-end, especially since we had odds to retest highs as early as October 22nd-24th. This is something I’ve discussed a bunch since end of September and early October, being extended through October 16th-22nd-24th-30th.

Considering we held range and sustained October 15th-16th, we still had odds in store for October 22nd-24th. Much of which was relative to holding the line this past week above 6688 and avoiding major downside volatility the week prior from the 16th. This puts us in a very interesting spot here heading into month-end and keeps us on track of our 7k potential goal for the remainder of the year.

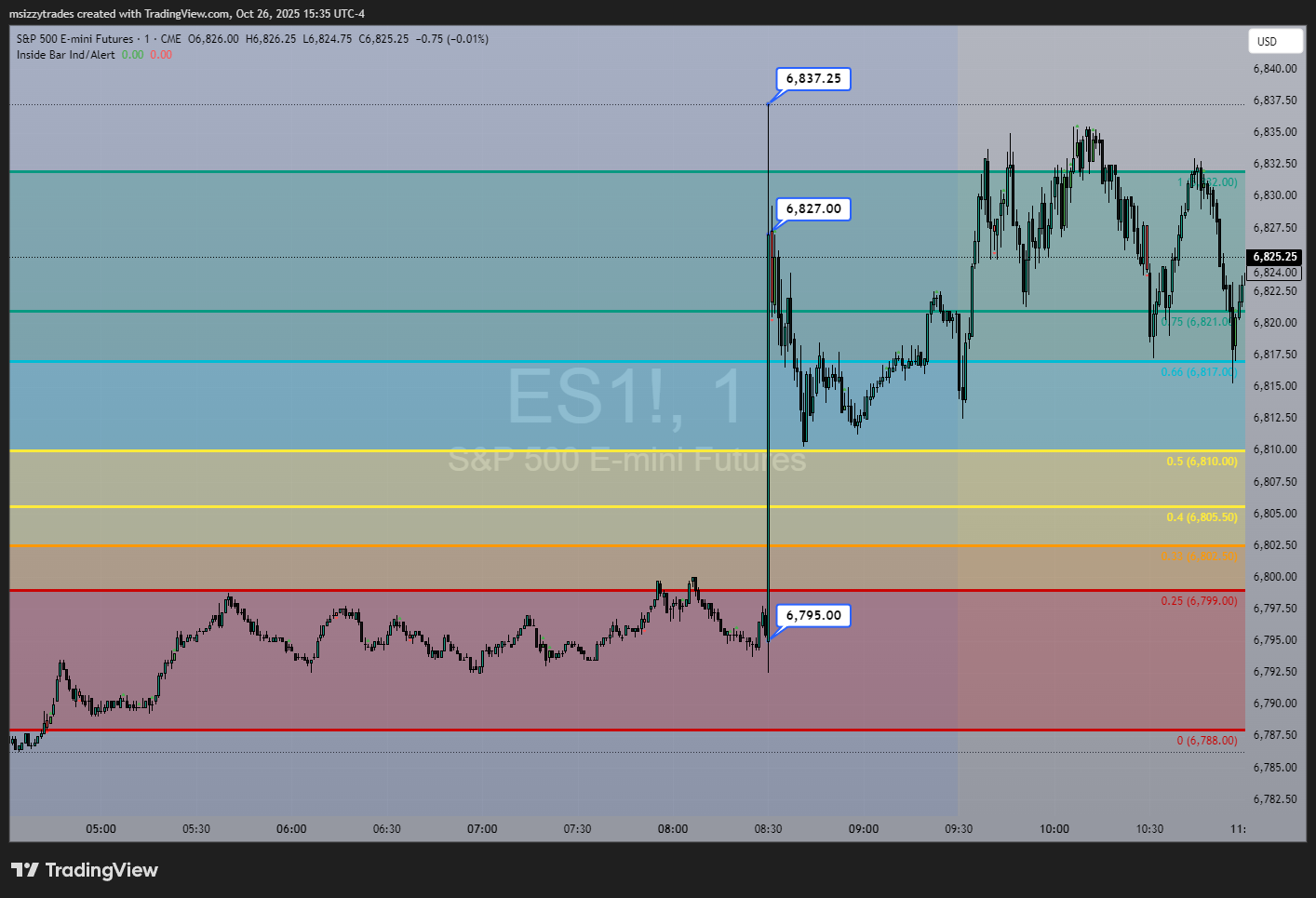

So, what can we look for now, with FOMC week and mega cap tech earnings? Well, for starters, we can watch our 256/346 point intervals which we’ll discuss beneath. But for now, we’ll stay focus on where we open in the zone or channel, since we almost always enter a zone or channel pre-macro releases, similar to how we entered the 6788 zone ahead of CPI prints this past Friday. We had held 6794 ahead of prints and also reclaim 6799-6801 like we wanted to for our overnight conditions. This set us up perfectly to break ATH of 6812 and also snap core ranges of 6822-6825-6828-6832. We even had enough momentum to continue through to our channel, above 6833, between 6838-6844.

Considering we pinned above 6822-6823, at 6825.25, but beneath the channel of 6832, this puts us in a great spot ahead of a very important week.

So, what does that mean for the remainder of the week? Are we just stuck in limbo or are there ANY probable odds in our favour? Well, there are some odds of breaking back into the zone area (6788-6832) but multiple structures working against us that can keep us delayed until November 3rd. Let’s do a deeper dive, shall we?